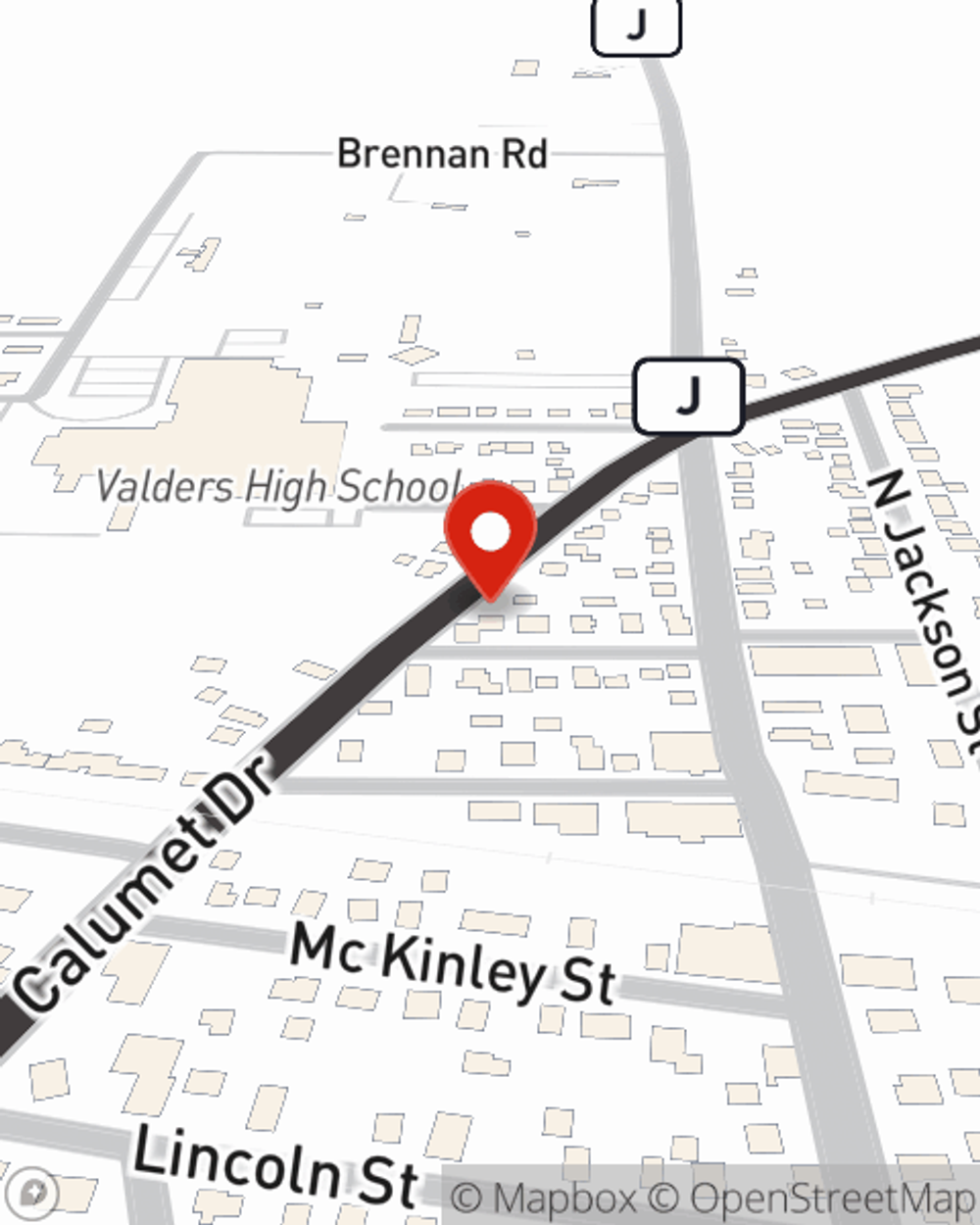

Auto Insurance in and around Valders

Auto owners of Valders, State Farm has you covered

Take a drive, safely

Would you like to create a personalized auto quote?

Be Ready For The Unexpected

With State Farm, you can have confidence that your auto policy is dependable and reliable. With many savings programs such as Vehicle Safety Features and Drive Safe & Save™, you could maximize your eligible savings. Not sure which savings options are applicable to you? Tanya Finch can work with you to determine which savings you qualify for.

Auto owners of Valders, State Farm has you covered

Take a drive, safely

Get Auto Coverage You Can Trust

You need State Farm auto insurance, the insurer trusted by 44 million U.S. drivers. When the unexpected finds you, State Farm is there to get you back on track! Agent Tanya Finch has the skills and dedication you need when unfortunate incidents cross your path.

Don’t let unfortunate events cause a hold up! Contact State Farm Agent Tanya Finch today and find out the advantages of State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Tanya at (920) 775-4115 or visit our FAQ page.

Simple Insights®

Buying an electric car

Buying an electric car

When looking to buy an electric car, what questions should you ask? We also provide information about charging units and the average cost to charge each year.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Tanya Finch

State Farm® Insurance AgentSimple Insights®

Buying an electric car

Buying an electric car

When looking to buy an electric car, what questions should you ask? We also provide information about charging units and the average cost to charge each year.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.